Eric Kneller: The Prophet of Profit

The Profit Mastery Blueprint:

Slash Taxes, Double Profits, Retire Right!

Who We Are

Your profits are my passion!

We are on a mission to get Millions Back to Main Street! With over 45 years of combined business experience. Our dedicated team works as an extension of your business. You have to benefit first, guaranteed!

About us

Maranatha Consulting

As our Name implies, we are always praying for things to happen quickly. The Small Business Saver Framework is guaranteed to work for you if you: hire employees, purchase goods or services, pay taxes, own commercial property, or invest in property upkeep and maintenance. It will rapidly put anywhere from $200,000 to $1,000,000 plus onto your bottom line in year one

Savings are profits

Use funding to expand

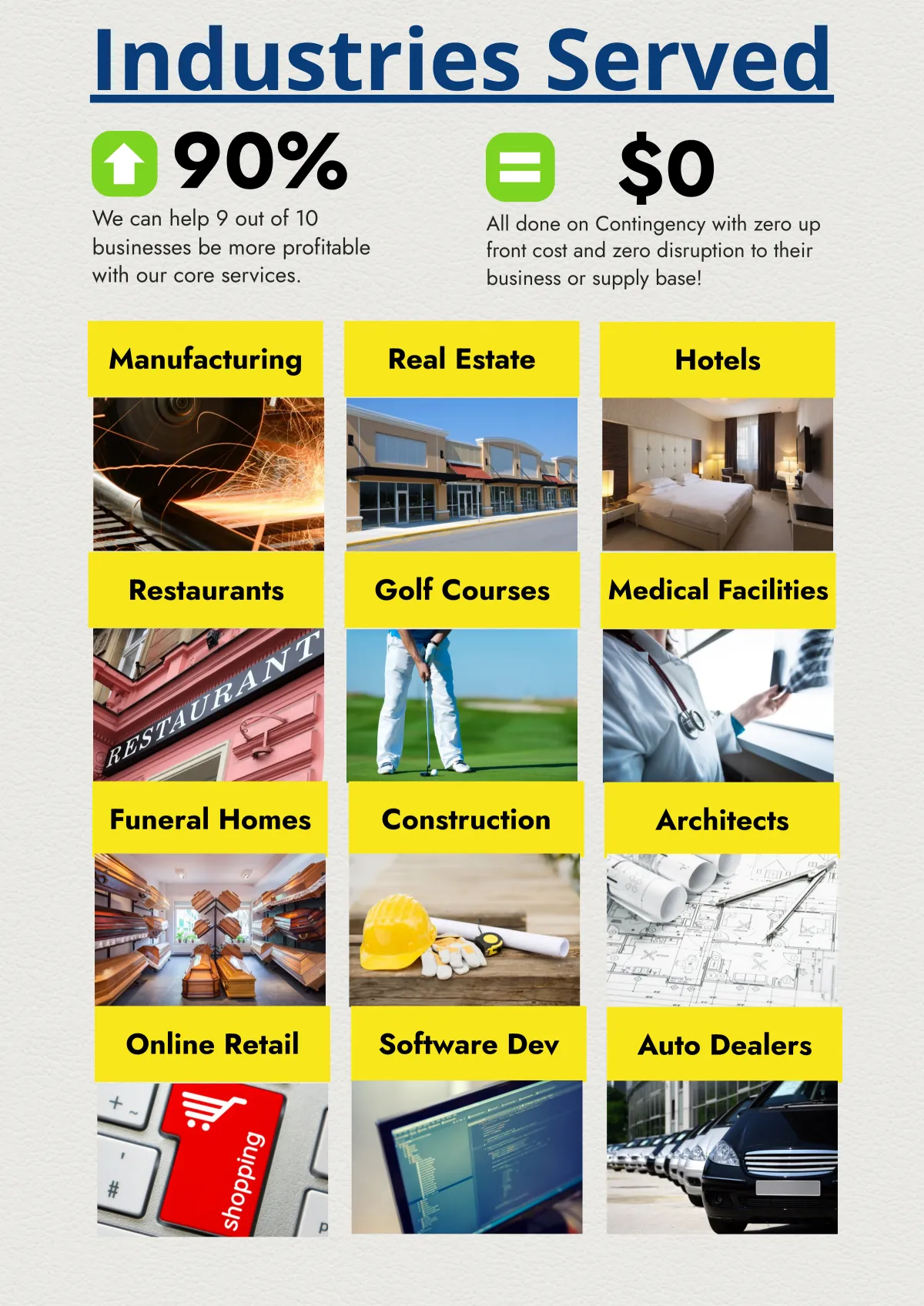

Industries Served

We can help 90% of businesses with 5-99 employees!

GET MILLIONS BACK TO MAIN STREET

Small Business Saver Packages

Take Advantage

6 Month Package

$0 Up Front

Identify Tax Incentives

Validated Savings

Property Taxes

Hiring Benefits

R&D Credits

Cost Seg Studies

Buy Better

12 Month Package

$5,000

Contingent

Tax Incentives

Strategic Sourcing

Contract Audits

Contract Negotiations

10X Savings Guarantee

Training

1 Day Package

$197

Online

Live & Recorded

CE Courses

Tax Incentives

Sourcing & Supply Chain

Exit Strategies

Slash Taxes

Power Purchasing

Fund Growth

Retire Right

Schedule a free 15 min review of The Profit Mastery Blueprint today and see just how much you can expect to gain this year!

The Small Business Saver

Eric Kneller

Latest Valuable Blog Posts

Testimonials

Frequently Asked Questions

Does My Business Qualify?

There is a 90% chance that the answer to that question is, "YES!" There are still provision of the CARES act that are offering tax incentives and rebates. And the truth is that most businesses are not taking advantage of certain incentives because they are outside the scope of work of their CPA or Accountant. That is not to say the CPA is not doing a fantastic job, he or she is just not focused on these specialized incentives and we are. We work alongside your CPA to help ensure you get as much as possible! There is zero risk to you and we promise that within the first 30 minutes (with the right information from you) we will be able to provide you with an estimate.

How Much Does It Cost For Me To Find Out If I Qualify?

$0 That's right...smile! We will work with you on complete contingency to find out how much The Profit Mastery Blueprint will save your business. We never take on clients we cannot help.

Are There Any Guarantees?

Yes! We guarantee that if you follow the steps in The Profit Mastery Blueprint you will: Slash Taxes and Increase Profits!

Get In Touch

Available Hours

Mon – Sat 9:00am – 8:00pm

Sunday – CLOSED

Phone Number:

908-797-2147

Office: Sarasota, FL

Call 908-797-2147